Latest Leader’s Interview Deep Dive

At the intersection of insight, strategy, and leadership— this is where conversations meet context. Our Deep Dive brings you up to speed with interviews of global and regional leaders, unpacking their perspectives on market trends, investment strategies and emerging opportunities.

From global macroeconomic shifts and cross-border capital flows to ASEAN dynamics and Singapore’s strategic role as a financial hub, we highlight insights from leaders in topics of policies, decisions and visions shaping the future. Whether you’re an institutional investor, family office or market strategist, this is your gateway to informed, forward-looking perspectives from today’s most influential leaders.

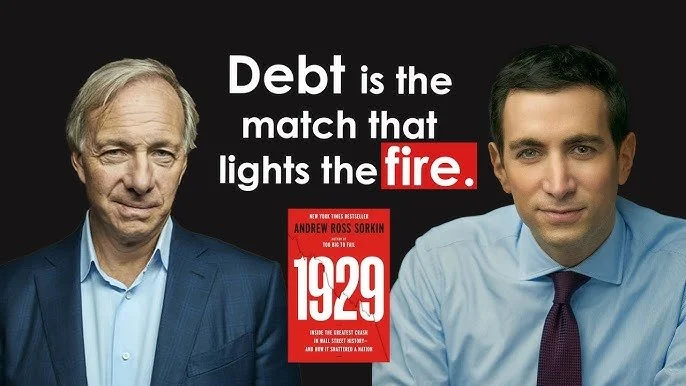

Ray Dalio Explains the Capital War No One's Talking About

In this interview with Axios, Ray Dalio discusses how global technology and geopolitical competition are shaping the future. He emphasizes that the nation leading in technological innovation will gain significant economic and strategic advantages.

Mortgage Rates And Falling Oil Prices

Cathie Wood explains how lower energy costs, easing housing market pressures, and trends in unit labor costs could help bring down inflation and interest rates. She discusses how factors like deflationary export pressure from China, productivity gains from AI and power build‑outs, and recent developments in Venezuela impacting oil prices might influence the broader economy and markets. Wood also touches on the implications for innovation‑focused assets, including the debate around Bitcoin as “digital gold.”

Club Conversation with Howard Marks, Oaktree’s Quiet Legend

In this conversation, Howard Marks shares his insights on investment strategies, the nature of risk, and the impact of market cycles. He discusses the origin of his company, Oak Tree, and elaborates on the concept of risk, emphasizing that it is subjective and tied to the possibility of undesirable outcomes. Marks also explores the upside of bubbles in technology, the implications of Brexit on the UK economy, and the current state of private credit.

Why Market Crises Keep Changing the Rules for Investors

The first 25 years of this century delivered one upheaval after another: the dot-com crash, the housing collapse, the Great Financial Crisis, unprecedented rounds of quantitative easing, a historic pandemic, an inflation surge, and a retail-trading revolution powered by meme stocks. Romaine Bostick charts how markets absorbed each shock, while Ray Dalio explains the deeper forces that shaped the modern investing landscape.

ARK Invest’s Cathie Wood on Performance, Nvidia and China

Cathie Wood shares why near-term volatility shouldn’t overshadow the long-term potential of disruptive innovation, offering insights into AI, Nvidia’s role in the ecosystem, and valuation discipline. She also highlights emerging opportunities in China’s tech sector and how conviction investing can uncover the next wave of growth.

ARK Invest’s Cathie Wood: Why We’re Betting Big on Tesla

The famed ‘innovation’ investor Cathie Wood talks about her biggest bets, the themes at play in Ark’s portfolios, and what she expects from its new space and defence fund. She also discusses some of the key trends occupying investor attention from the last year - from trade wars to the touted demise of US exceptionalism.